Payment Matching Task

at Clarity

Company Introduction

Clarity is a financial technology company that builds intelligent tools to help businesses automate and manage their financial operations with confidence. By combining data analytics, automation, and intuitive design, Clarity streamlines complex workflows like payments, reconciliations, and financial tracking — enabling teams to focus on growth rather than manual work.

Driven by precision and transparency, Clarity partners with organizations to bring clarity (literally) into their operational processes. The platform empowers finance and operations teams to make informed decisions, reduce errors, and scale efficiently, all while maintaining full visibility and control over their data.

Overview

As transaction volumes grew, the Payment Operations team faced increasing challenges reconciling approved payments with bank transactions.

The existing manual process required checking each record one by one — slow, error-prone, and nearly impossible to scale.

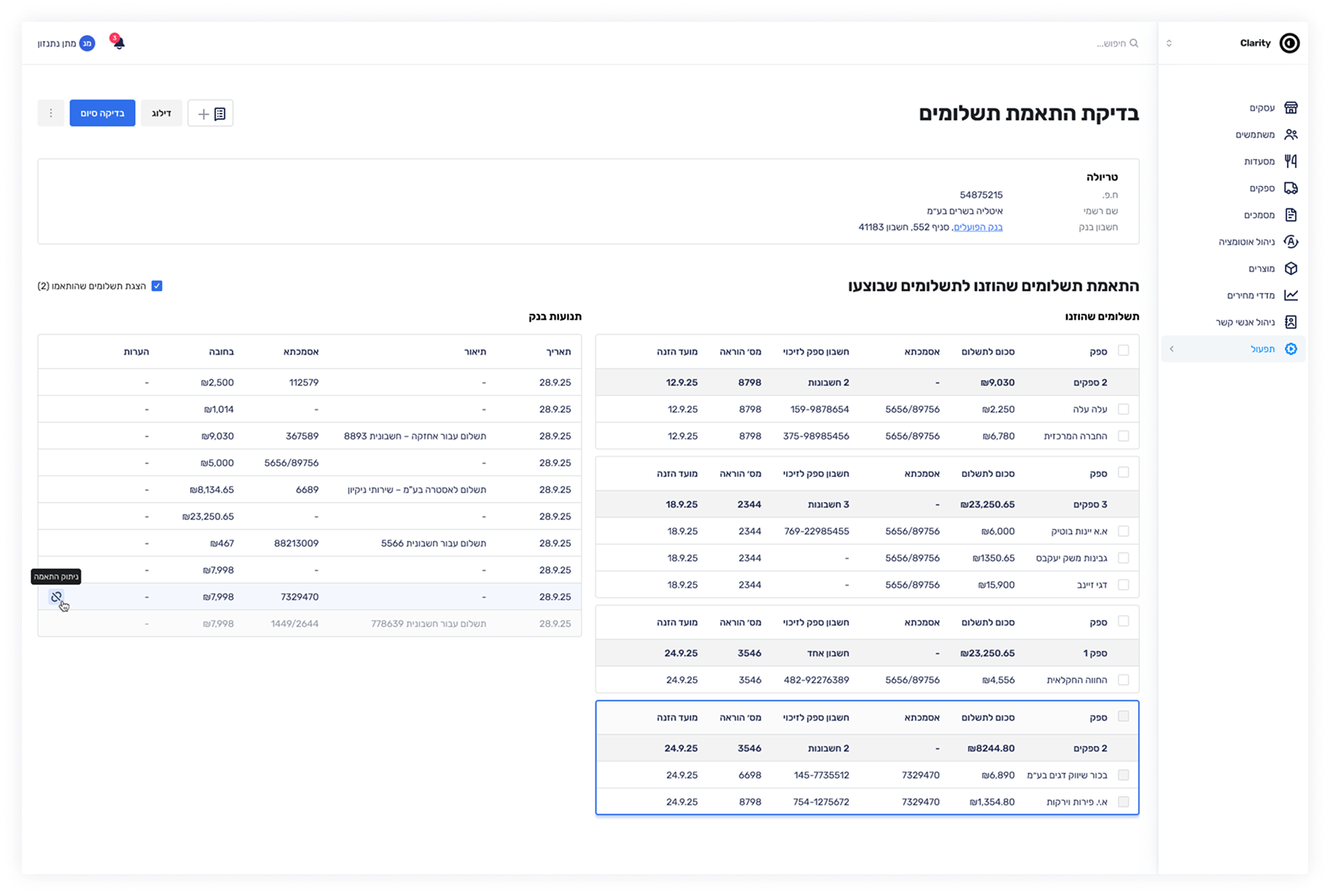

To solve this, I designed “Match Payments”, a new task-based system that automates matching suggestions, introduces ownership and visibility, and ensures every payment is reviewed systematically.

The result is a smarter, scalable workflow that saves time, reduces friction, and empowers the team to focus on what matters most.

The Challenge

The payment operations process relied heavily on manual checks across multiple bank accounts.

Each operator had to cross-reference approved payments against uploaded bank files — line by line — to verify that every transaction matched correctly. This repetitive, time-consuming workflow made it difficult to maintain accuracy and visibility as payment volumes increased.

Without a structured system in place, there was no reliable way to know which payments were already matched or pending, to prioritize by status, or to prevent duplicates and mismatches. As a result, the process became slow, error-prone, and nearly impossible to scale efficiently as the client base grew.

The Goal

The main goal was to transform a manual, fragmented payment verification process into a structured and scalable workflow.

The new system needed to provide clear task ownership, better visibility, and automated support for matching payments to bank transactions.

For team leaders, the goal was to ensure that every approved payment could be systematically reviewed and tracked from start to finish.

For team members, it was about simplifying daily operations — reducing manual effort and enabling the platform to automatically suggest the most accurate matches.

The Process

To tackle this critical scaling problem, I initiated a series of discovery workshops with the Payment Operations team. The whiteboard sessions were essential for mapping the broken manual workflow and translating their pain points into clear user goals.

The discovery process uncovered two strategic needs:

- For Team Leaders: A systematic, task-based system for accountability and a clear overview of what has been matched.

- For Team Members: Smart automation and recommendations to reduce manual clicks and save time.

These sessions directly shaped the solution: a new “Match Payments” task type. We co-defined the core logic, including automatic filtering rules (like exact amount matching), crucial validations (like blocking incorrect bank files), and the complex matching logic required for specific banks like Leumi.

User Persona

Sapir Leibovitz is a Payment Operations team member at Clarity, responsible for verifying and matching approved payments with bank transactions. Her work requires accuracy, speed, and transparency across multiple restaurant accounts. As Clarity scales, Sapir struggles with manual workflows that are slow, repetitive, and prone to human error. She needs tools that automate matching, surface the right tasks at the right time, and help her team maintain accountability as volume grows.

Sapir Leibovitz

Payment Ops Team Member, 28 y/o, Clarity

“I want to spend less time on manual checks and more time ensuring every payment is matched accurately. Smart automation and clear task ownership will help our team scale without losing control.”

Motivation and Goals:

Ensuring every approved payment is matched quickly and accurately. Reducing manual effort by automating match suggestions. Providing her team with clearly defined tasks that track who performed each check and when. Maintaining high transparency and accountability through task assignments and closure tracking.

Challenges:

- The current manual system is not scalable — checking one restaurant at a time is slow and error-prone.

- No prioritization or visibility of which payments still need verification.

- High dependency on manual judgment, increasing risk of mismatches or duplicate checks.

- Different banks behave differently, making it harder to standardize processes (e.g., Bank Leumi supports multiple-line matches).

- Ensuring validations (e.g., correct bank account, correct amounts, no double matching) are consistently enforced across the team.

Goals and Use Cases:

- Task Management and Accountability: Sapir needs a structured, task-based workflow that clearly shows which payments were matched, by whom, and when — ensuring ownership and team visibility.

- Automation and Efficiency: She wants the system to automatically suggest likely matches based on logic rules (e.g., exact amount, date) to save time and reduce repetitive manual work.

- Error Prevention and Validation: The platform should block invalid uploads and prevent duplicate or incorrect matches, maintaining accuracy and data integrity.

- Scalability and Transparency: As transaction volume grows, Sapir needs a standardized and transparent system that supports consistent operations across banks and team members.